Last Friday, March 29th, Permodalan Nasional Bhd (PNB), one of the investment mammoths of Malaysia announced its dividend distribution of a record high of RM15bil for the financial year ended Dec 31, 2018. The same article said PNB has successfully maneuvered through a challenging economic environment in 2018 to achieve a 6.9% increase in assets under management (AUM) to RM298.5bil from RM279.2bil the previous year. It has caught my attention for the fact that KLCI has its worst performance in 2018 with a loss of 5.91%, why is it then PNB was able to achieve a positive income?

In February 16th, 2019, Employee Providence Fund (EPF) declared dividend distribution of a rate of 6.15% to its conventional members. Again, another investment mammoth of Malaysia was able to earn positive return from the same market down year. While most market players, including equity market fund houses did not make it positive for the year 2018, incredibly these investment mammoths or giants were able to beat Malaysia market index successfully.

Furthermore, as the largest investment mammoth in Malaysia, EPF has a miraculous dividend distribution history even when recession hit global market. It has never failed to serve its massive members with attractive dividend rate higher than bank’s fixed deposit.

Responsible Financial Care Takers

Part of the reasons is that these investing mammoths invest conservatively into less risky investment assets like bond, money market, property or reits, or resilient stock with high dividend rate. Because of the gigantic size of their asset under management (AUM), they are not free to enter and withdraw from the market at will like any retail investor. That’s why these responsible investing giants must be very cautious to place where they money is.

Even though with such large fund size under taking, they can take advantage whenever market crashes. They will seize every opportunities as these are just temporary dips by buying more and positioning themselves for the next market upswing.

However, not all crashes will eventually recover to higher heights. In rare cases, market will find themselves heading towards bearish trend, especially during economic recession. In this case, these investment mammoths are among the worst hit and the largest casualties. They are mostly trapped and went down with the market index.

Even then, they can still distribute handsome dividend to their members like EPF. This is because they still received massive dividend income from dividend stocks they have invested. Furthermore, their investment value downslide is also mitigated by defensive position set by bonds, money market, etc.

Aim Lower Achieve Firmer

These investment mammoths don’t normally aim for double digit growth each year. Partly because it is not easily achievable out of their cumbersome fund size. Secondly, a single digit growth means hundred million of profit income for them. This amount number itself is overwhelming to all business people. As a reason, so long as the rate of growth is higher than bank’s fixed deposit rate, it would be their monumental record worthy.

For retail investors, we do not normally aim for single digit annual growth in our investment. Because the amount of income looks so insignificance and unattractive. However, we must realize that there will be time a single digit growth is much better than losses in our annual investment assessment. This is especially true during bad investment year, market topping, uncertain market direction or recession period.

Learn to be a Good Money Manager

There will also be times in our life journey that we will have a large sum of cash entrusted for our care. Times such as receiving cash redemption from maturity of life insurance, retirement fund, inheritance, or property disposal etc. We all know placing such large sum into fixed deposit would be the least thing we would do knowing the disadvantage of the depreciation value due to inflation. This is the time normally people will go to the stock market and starting to “give away” freely their large sum of cash to market sharks slowly and surely.

Don’t we realize that this will be the best time to handle our entrusted large sum of cash if we know how to manage with the style and strategy of those investment mammoths. With such large sum of capital involve, if we just aim for single digit annual rate of profit return would probably means winning a large sum of money or even contributing financial freedom if the total capital sum is gigantic in size. The key question now is the knowing how to make it!

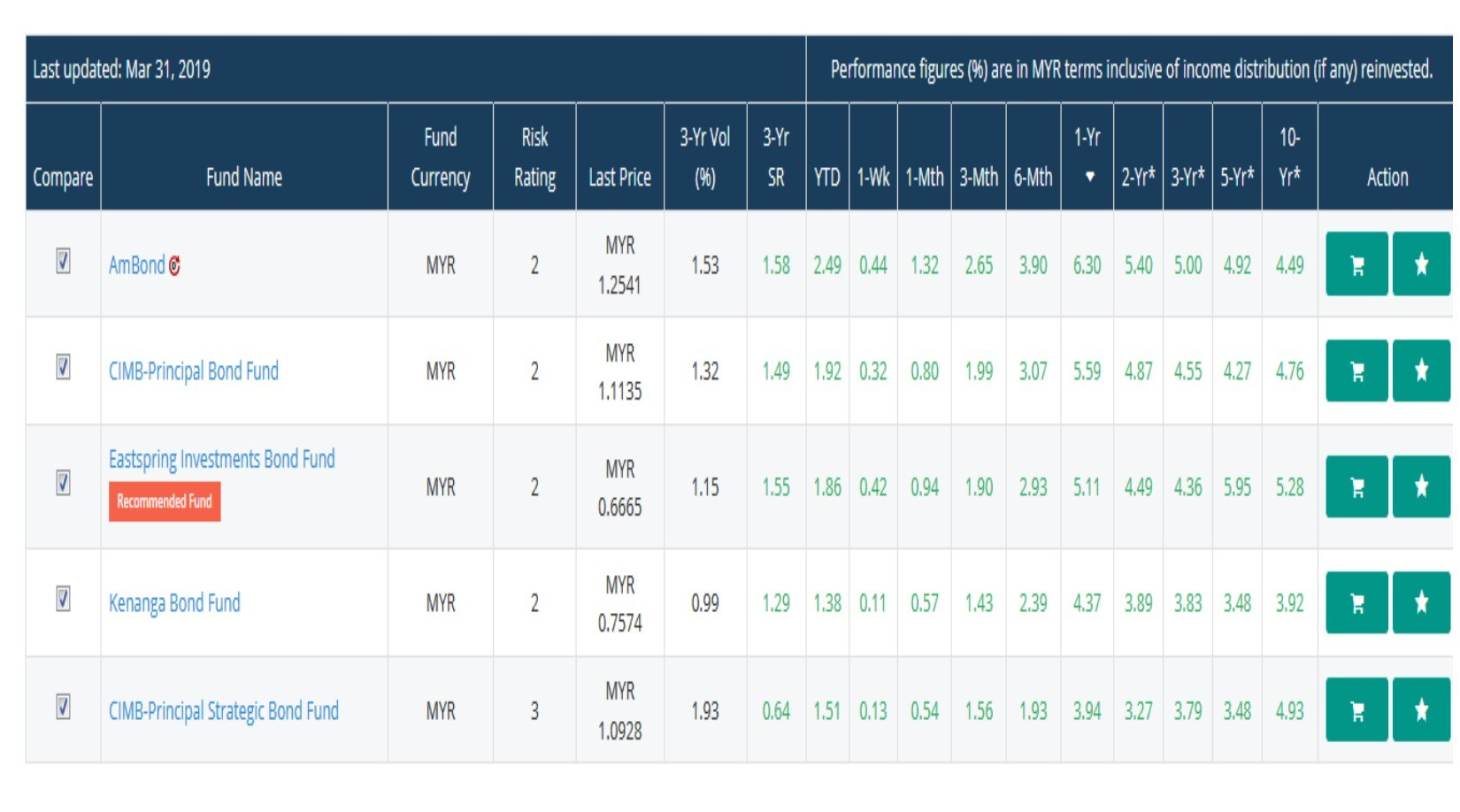

If we just look at Bond fund return in Fundsupermart investment platform, among those bond funds easily accessible by retail investor, their performances are currently showing the annual return of a single digit mostly higher than bank’s fixed deposit. You might probably think this will be “no sweat” task. We would just place our capital wholly into this bond fund, say AmBond, for example. Within a year, we shall achieve such investment mammoth annual return of a single digit. However, I would just give a word of advice; this is easily said than done.

Tame Our Hearts

With market swing, development, analysist report and economic news and other investment achievements, it is not an easy task to keep your heart tamed and unmoved by greed. It is very easily be tempted to move your fingers to change your plan away from sticking with bond fund alone for a longer period if others are achieving a much better return than yours. In doing that you are risking yourself of getting lower or even ends up with a negative result by the end of the calendar year. You must try it in order to get the experience and be certain that you can do it for a year alone, let alone for years.

Additionally, in order to beat annual return of these mammoths, Bond fund alone will not help you to get there. You must mix your portfolio with a small allocation to equity funds, say 10- 20%. If you do it right, you could possibly achieve a higher return for more than 7% for this year. By the end of the year then, you might be possibly declared that you have beaten these investment mammoths successfully.

Do not look at the total amount of your profit, just measure according to your rate of annual return. Because you are preparing yourself to be able to achieve or even beat investment mammoths shall the day comes.

In times of market uncertainty like now, wouldn’t be it a perfect opportunity for us to learn how to beat investment mammoths now than doing nothing? Just like what our online lesson motto said, “learn before you earn.” If you have learned those investment technique and skill, profit earning will follow you for the rest of your life.

Happy investing but invest safely!

Press Here to go to Front Page

Please press “like” button below this article (if you have not done so) for email alert whenever new releases are out for public viewing. If you have any comment, please make use of the comment section below for readers’ interaction.

Disclaimer

The view and opinion expressed are personal views of the author and are subject to change based on market and other conditions. This write up does not constitute sole advice for investment decision. Investors are advised to do further reading and research to conclude individual decision.

One thought on “How to Beat Investing Mammoth”