This article comes with this question might have caught your attention. Kenanga Growth Fund had been an excellent fund for all times, why have I asked this question? Shouldn’t we keep holding on to this dear fund?

Yes, you are right, Kenanga Growth Fund has been the greatest star fund ever since I came into this unit trust investment. It has been one of my best favorite funds as well. It has helped garner some profit into my pocket too.

Most Recommended Fund

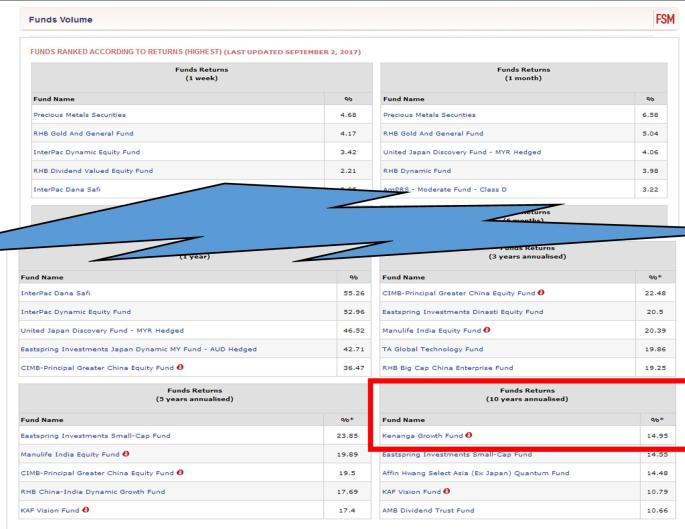

I have also noticed it has been greatly recommended by Fundsupermart team for many years, except recently. It was consistently listed as top performing fund on Fundsupermart Board for 3 months initially, then 1 year for awhile, then 3 years for a few years …. Now, it retrieved to 10 years category only.

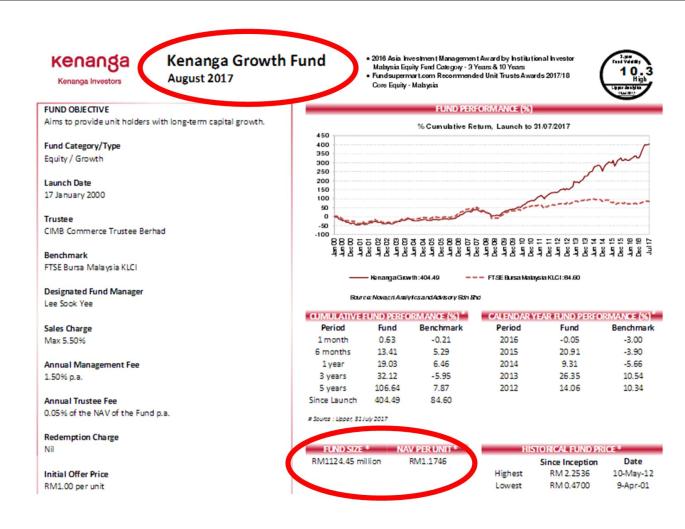

What was shocking to me when I tried to check on its capital lately before I did recommendation to a new investor following me was its accumulated size of capital (Asset under Management or AUM). Its capital or AUM has ballooned up to 1.12 Billion as of August 2017. For most Malaysian mutual trust fund, capital size is around 10’s of millions to early few hundred millions. When it comes to a late few hundred millions, it is considered a large size cumbersome enough for the fund house to consider a “soft closure”. (Cross reference: Affin Hwang Select Asia (ex-Japan) Quantum Fund was closed at a fund size of about 632.5 Millions and Eastspring Investment Small Cap Fund was closed at a fund size of around 668.4 millions.) Kenanga Growth Fund has already enlarged beyond this size and reached up 11.2 Billions and still not yet declare Fund closure.

Investor has to understand that fund closure is not a simple decision done by single body. Most funds operate with quite a number of agencies around. These are sale agencies, creditors, shareholders, management and others. Fund closure will affect the interest of each of these agencies. Therefore conflicts of interest within these agencies or even among management itself, may cause delay in declaring closure. When the closure consensus was finally reached, the fund performance might have already been damaged beyond remedy. Has it been that Kenanga Growth Fund is right now battling over this closure decision and has been delayed until present?

Fund Recent Performance

However, fund size itself hardly an indicator alone for fund deterrent. Fund manager might have outgrown his previous capability and ventures into a new arena on higher ground though. Then a double check on fund comparison on individual performance does further verify my worry. Among all Malaysian funds, Kenanga Growth Fund failed to be listed on top 10 best performance fund for up to 2 years according to Fundsupermart platform as of 6th September 2017 fund selector screening. There is an obvious regression for Kenanga Growth Fund performance.

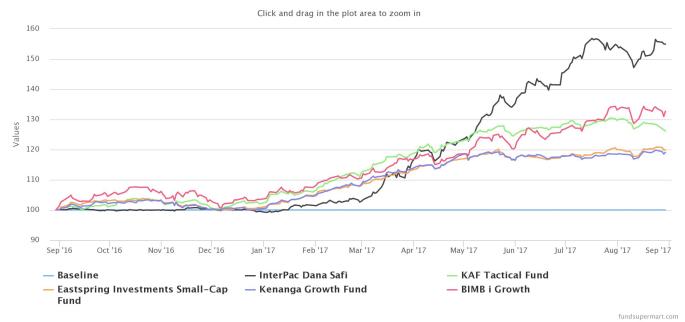

If we were to compare among some starring Malaysia funds between CIMB –Principal Small Cap, KAF Vision Fund, BIMB i Growth, InterPac Dana Safi and Kenanga Growth Fund, for a period of recent 1 year, Kenanga Growth Fund appeared at the bottom (as of 6th Sept 2017 data). As a long time patronage of the fund, it’s about time to seriously reevaluate its performance and its future direction. Is there an indication that the performance is deviating from its past standard of performance? Is this the only good performing fund in Malaysia market that deserves our continuing support without any waver?

Well, the call for highlighting and appraiser is mine; the decision to make any chances is entirely yours. As the Fund Fact Sheet of Kenanga Growth Fund has a constant reminder saying, “Past performance is not an indicator for future result.” Do you think this reminder is practically useful in this case?

Thanks for reading this article.

Postscript: A follow up blog is written on this subject, please read also in What’s Wrong with Kenanga Growth Fund.

Disclaimer: The author expresses his view based on his own learning experience for reference only. Readers are advised to use individual assessment to do investment.

Press Here to go to Front Page

Please press “like” button below this article (if you have not done so) for email alert whenever new releases are out for public viewing. If you have any comment, please make use of the comment section below for readers’ interaction. If you want to contact the writer personally, please fill in the form below.