New year period for a Chinese is around January 1 of each of new calendar year till the 15th first month of the Chinese Lunar calendar. This is almost ranging around 1 to 2 months period. No Chinese will feel really have entered a new year unless he has gone passed the 15th first month of the lunar calendar. No wonder the Chinese are able to make wonderful progress in many areas of business realm. Because the Chinese have a longer period for reflection and make their New Year Resolution!

New year period for a Chinese is around January 1 of each of new calendar year till the 15th first month of the Chinese Lunar calendar. This is almost ranging around 1 to 2 months period. No Chinese will feel really have entered a new year unless he has gone passed the 15th first month of the lunar calendar. No wonder the Chinese are able to make wonderful progress in many areas of business realm. Because the Chinese have a longer period for reflection and make their New Year Resolution!

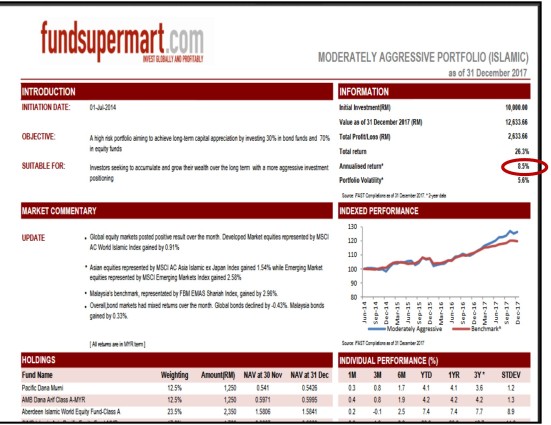

Recently after I read an article written by Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital entitled “2018 – a list of lists regarding the macro investment outlook”, I have come to discover that a return of 10% per year for 2017 for super fund size with balance portfolio should be a very good return for unit trust investment. Many investors may not be able to achieve such return especially for novice ones.

Consistent Return as Key to Investment

We are talking about consistent return in investment. The key for unit trust investment is the ability to garner consistent return on a yearly basis for a long period of time. Even though the number you see would be unimpressively smaller.

Let’s just put aside for those stock investors who claimed to have received more than 70% of return last year. We are here talking about consistent return, not just one time high return. Because these investors would like to impress their followers and retain their faithful support by always reporting good news. They will never let you know how much they suffer when they lost. Unit trust investment is the simplest investment tool that can easily generate consistent annual return.

Since Oliver places a 10% return as a good annual return for unit trust investment for 2017, we shall place this number as a bench mark for our evaluation of annual return for 2017. If you have achieved this rate of return or higher, I would like to congratulate you. You have done very well, if not exceptionally well.

If you have achieved a lower rate than this 10%, please do not feel discouraged. Just make personal assessment in the area of weaknesses and move on for better or improve return for 2018. The recommended portfolio of Moderate Aggressive (Islamic) portfolio put up by Fundsupermart is also only having 8.5% return for last year.

But the key note is “learn” before you “earn” as what my online classes have advocated all this while.

Performances of Online Course Graduates

For curiosity and concern, I have checked with a number of my followers and online course graduates in order to find out how they were doing. I have just amazed to discover that they did not know how to actually count the annual return rate. One of them told me he was only having 10.7% total return for 2017. But after I have helped him out, his return was actually 12.11%. Another new graduate who has started not long ago was also thought that his annual return rate was only 4.2%. After I sorted out with him, he was so excited to find out his annual rate of return was actually 15%. However his investment period was lesser than a year. I have actually hinted him maintaining 15% for a year is not easy. I hope he will try to maintain as much as he can.

As for my own investment return, the annual rate for 2017 was 14.3%. Before I read the above article by Oliver, I was expecting a much higher return, like 17 – 18%, or somewhere near 20%. As I wrote before that we as retail investors, an annual return of 10% will not lead us anywhere towards financial freedom. We shall aim for 20% or somewhere near that mark. So my rate of return for 2017 was actually not very satisfying though it is still enough to bring comfort out of what Oliver said as it is actually more than 10%.

Much More Lessons to Improve

As I evaluated myself, I have discovered a few weaknesses which I need to overcome by 2018. Firstly, I began the year 2017 by over diversify. As I have mentioned, I am overseeing 17 portfolios out of 7 Fundsupermart Accounts from my family members and siblings with a total capital of 6 figures, it is hard to manage with efficiency. I have invested into too many funds out of try and error or curiosity even though these funds come from targeted geographical areas. But I have overcome this weakness at the ending period of 2017 by narrowing down those fund selection. And fund performances have been doing much better ever since after then. And by next year, I shall even have to learn how to sharpen this fund selection further. I shall cover this topic in next blogging if possible.

Secondly, I started with too conservative even though I saw 2017 was an excellent year for investment. While waiting for market dips so that I could increase more position, or change gear to be more aggressive. But the serious market dip did not happen for the most of 2017. So my good opportunity for investment has been wasted partially. I have learned some good lesson here. I shall be positioning differently by 2018 with different investment strategy.

For market outlook for 2018, if global economic recession doesn’t come yet, not at least for the first half of 2018, we shall continue to harvest more learning opportunity, not just for more profit. Because again, we shall “learn” more before we “earn” greater profit!

Happy investing!

Press Here to go to Front Page

Please press “like” button below this article (if you have not done so) for email alert whenever new releases are out for public viewing. If you have any comment, please make use of the comment section below for readers’ interaction.