“Are you serious?” You might be wondering, “How can investing in unit trust has any advantage over stock?”

As I searched the internet, I found out there are more information about stock investment than unit trust investment. Stock investment or trading is more interesting and attractive then unit trust for various reasons. However, the flip side of it has never been talked about. In this article, the flip side (disadvantage) of stock investing or trading will be the advantage of unit trust investment (or unit trust trading if you want to do it that way). You will see what real investment really is when it comes to unit trust instead of direct stock involvement. Please read this article yourself and make your own decision or valuation.

1. Compounding Growth of Capital Is More Possible with Unit Trust

Stock investment has the possibility of increasing your wealth exponentially over a short period of time. This is what makes stock attractive to most investor. However it also ensnares investor to fall into a trap of over confidence. Eventually it can totally wipe out one’s capital if it is not under good control. The key to successful investment over time is consistency. Any big profit is nothing beneficial if it doesn’t come with consistency. A few big winning initially can be totally wiped out just one heavy loss at the end. This is nothing of investment, but gambling.

However, this will not ever happen in unit trust investment. There is not going to be any big winning in any way. Profit in unit trust comes in slowly and gradually. This characteristic makes unit trust a possible success in investment business. Compounding growth of your investment capital comes easily with unit trust investment than stock. A small annual return of investment as low as 15% investing in unit trust can generate a million ringgit capital growth eventually if an investor starts with just RM 25,000 and top up with monthly regular saving of merely RM 500 for 20 years. If that is not enough, 5 more years, it will be 2 millions.

Yesterday, when I reviewed some of my unit trust investment portfolios, I found one very encouraging example of how compounding investment benefit works for the best. It was an EPF investment portfolio started 2nd August 2009 with RM 4,000.00. It was subsequently topped up with another 2 times with RM 4,000.00 each in between 5th Nov 2012 and 19th August 2013. By 20th September 2013, the capital has already grown up to RM 13, 489.14. By January 2017, this capital has been compounded into RM 16, 615.69. And by now, in 14th October 2017, this portfolio has reached RM 20,085.32. An increase of profit of RM 6,596.13 has happened.

This has nothing spectacular if you consider the length of time spent with a spread of about 4 years. The CAGR (Compounded Annual Growth Rate) is merely 11.98%. However, what was encouraging to me was rather on the compounded effect on this year. Out of the RM 6,596.13 profit, a large chunk of it (which is RM 3,469.3) was actually brought in this year alone (with Annual Growth Rate of 25%).

It was started with the expanded or compounded capital of RM 16,615.69 at the beginning of this year. It would not be possibly reached this figure if it were to do with the smaller capital way back 4 years ago with only RM 13,489.14. This is what I have found the most encouraging reason to celebrate and share with you ~ the compounding benefit of investment. And this is only a small foretaste of the future incoming prospect. And this is possible only when there is a consistent inflow of profit in investment over the years.

2. Investing instead of Gambling

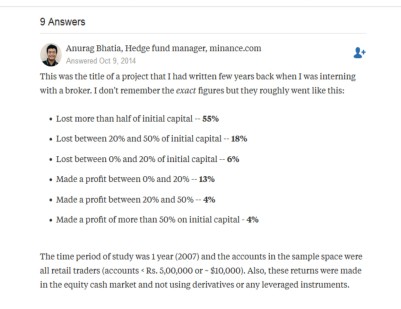

The game of stock market is exciting, because it can bring in quick and fast gain beyond expectation. However, it can also disappear as fast as it comes. As a result, stock market players cannot sleep well when they see their investment profit on either direction … growing or shrinking. Stock market experience is a highly intensified emotional ride. As a result, statistic has shown that over 80 -90% of stock investor loss money in stock market. Someone has made a statistic study for one year analysis among investors, almost 80% of them lost money in that particular year (Please refer to Picture A for illustration).

If you are one of them, do not feel anything unusual. You just need to know that stock market hardly make investment successful. If you are still struggling, a change of investment vehicle is a better solution.

Unit trust investment does not have this characteristic. Investor can normally sleep well at night. It has low volatility on either side… either gaining or losing, it comes in gradually and slowly. There is always enough time to do any remedy if it shall deem necessary. Total Investment Capital will not be possibility lost over night like stock investment does. As a result, black swan event followed by global recession is most threatening for stock players than unit trust investor. As the graph in picture B shows that all sufferer in global recession during 2008 losses are retail investors due to emotional issues. While non-retail investors, most of them were fund houses, were gainers.

3. Scope of Choices in Investing

Choices of stock are always limited in one particular market like in KLSE. They all come with systematic risk. Once global market Stock crashes, they all crash down together. However, in unit trust, there are much more variety of non-correlated investment choices like equity, bond, money market, precious matter like gold etc. In other words, unit trust investors can be profiting even in bear market if they switch into gold, bond or money market for safe haven protection when they do it at the appropriate time.

Unit trust can invest in a lot more variety of investment then stock market in KLSE. Aside from business enterprises, Unit trust can also turn to US energy, commodities, agricultural products etc. and outside of investor’s own country as well.

When a particular geographical area or country is getting into bear market or sideways, unit trust investor can always choose to switch into another country or geographical area where the bull is still running strong. In this way, his capital appreciation will not be in any way dragged down just because of the economy of his own country is slowing down or consolidating temporary. Bull market is essential for generating profit in stock investment. In short, unit trust investment can easily invest globally instead of limiting to one own country and it can be easily switched back and forth without changing account or having the trouble to do wire money transfer to foreign investment account.

4. Hard work Required for Stock Investment

For value investor, there is always a lot of study work before investing. Even if hard study has been carried out, the conclusion of a worthwhile security is not always fool proofed neither. An under value stock does not necessarily be a future growing stock. Sometimes even a profit generating corporation does not guarantee its stock price will rise too. Stock prices sometimes even go opposite to the underlying corporate earnings report. So much so even an Italian American academician and author, Eugene Fama after extensive and comprehensive studies for fundamental analysis stock investment principle concluded, “fundamental analysis is a fairly useless procedure both for the average analyst and the average investor.” (How Markets Fail, p. 89)

It takes more than just profit generating factor to move a stock price. And those price moving factors are normally more complicated than retail investor can possibly know. In short, there’s a lot of guessing work to do even in value investing game and that guessing game is never anyway easy. Worst still, retail investors, especially beginners who do not have any business sense or background find this guessing work even more puzzling.

However, there is no need of guessing in unit trust investment. When the macro economy in a segment of economy is growing, prices of unit trust fund invested in that particular market segment will surely be rising. Because of its widely diversified strategy being employed in all unit trust fund houses, positive effect in fund prices will always be brought in.

As retail unit trust investor, it does not demand hard work analyzing micro activities of an economy like in stock investment. Just the macro view will be sufficient to allow retail unit trust investor to enter profiting journey. This factor makes investor sleep well at night. There is no worry of any bad news come out of any single company you have invested adversely affects your investment as if in stock. In stock investment, there is a valid worry that the capital might be possibly totally wiped out.

5. Legal Speculators Always Present in Stock

Speculation activities cannot be avoided in stock market no matter how hard the work the Security Commission trying to put in. These activities make stock investment business complicated. Big players are often the legal speculators in stock market. Because they are the ones licensed to do certain market activities whereby retail investors cannot do. For example, buying and selling in big volume within a day. This is one of the reasons why retail investors often victimized in price trapped, which means small fishes being eaten up by shark. Do you know who are those big players licensed to do speculation? They are the fund managers. As the saying goes, “if you cannot beat them, join them”. Investing through unit trust, you are actually join forces with winning team, instead of staying with the losing gang.

6. High Market Valuation Condition

It is hard to find any more value stock to invest for long term when any market is in high valuation condition like in KLSE or US markets currently. However, there is a flexibility to choose undervalue market condition at overseas like in China, India, or emerging markets and others in unit trust investment. Investing in foreign market comes easily with unit trust because all those hard works have already been done professionally by fund houses. A mere macro understanding of a certain geographical market condition is all what we need to know and decide before we invest our capital successfully.

7. High Cost in Fees and Commissions

There are always entry and exit commission charges for every stock transaction. It is very costly for constantly trading stock. However, there is only one single entry charge (once in a life’s time) for unit trust investment. Free switching is always available for unit trust investment if you know and follow the rules of each individual fund house.

Because of the entry commission and fee charges, every purchase of stock are charged according to a rate in proportionate to the volume of the purchase. (For example, a purchase of 1,000 lots is charged with 0.12% versus a purchase of 10 lot is charged with 0.80% commission fee) The higher volume the purchase is, the lower the fee it becomes proportionately. Conversely, the lower the purchase of stock unit it is, the higher the fee in proportion to the units purchased it becomes. Therefore, stock market is designed for the rich and the wealthy. Retail investors with small capital will always find it disadvantage to invest or trade in stock markets. This is one of the keys retail investors must come to realize before continuing stock investment.

However, in unit trust, the charges of purchase is flat according to the number of unit purchased, not according to a certain rate in proportion to volume. Unit trust business is designed for general public. Anyone with a capital as low as RM 200 can come in to make his first initial purchase of investment. This is where my three sons started when they were still in their primary school age. By now, their capitals have grown to become thousands.

Furthermore, the minimum unit in holding is always required very low too. In stock transaction, the minimum holding is in 100 units (1 lot) per share in Malaysia Stock market. And the transaction cost will be costly. Any number lower than 100 units in stock holding will be considered “odd” lot and it can only be sold out with the help of the remisier. Odd lot happens only after dividend distribution, but can never happen in any market purchase. There is no “odd” lot in unit trust business. Unit trust can buy and sell even to the decimal number of unit (i.e. 1234.12 units).

These are the major differences between the cost of stock and unit trust investment and their holding requirement. Again, unit trust investment has a better advantage over stock in this perspective.

8. More Liquidity in Unit Trust Transaction

In buying and selling of stock, there is always a price queuing in the open market for a certain price and volume waiting to be agreeable by two parties. When two corresponding parties are matched, then transaction will take place successfully. If it doesn’t take place, it has to be queuing up again for following business days for the same purpose. However, in unit trust transaction, there’s no queuing for buying and selling. Liquidity is always an advantage of unit trust transaction. Fund houses will always be there to buy and sell unit at the determined price for the day for any transaction.

If you found yourself heading no way in the midst of investment through stock, it would be probably the best time for you to consider the alternate investment vehicle, through unit trust. If you are a Malaysian, what you need to do first is to open a new account (FOC) with Fundsupermart.com.my. If you are residing in Hong Kong, India, or Singapore, you may still find Fundsupermart Unit trust investment portal in your country as well. If you need any strategic assistance investing through unit trust, you can also find online trading course from Treasure Hunters. Currently, however, it is only available in Chinese. Hopefully the English course can be ready as soon as possible. You can write in to request online training course in English in order to encourage me to get it ready sooner.

Happy investing through Unit Trust!

p.s. Please read more discussion in follow up article on “What does it Mean Unit Trust Investment is Better than Stock?”

Press Here to go to Front Page

Disclaimer: The author does not have any business affiliation with Fundsupermart aside from being an independent retail investor. He does not seek any compensation in monetary term while recommending investing through its platform neither. Investors are advised to made independent decision to open account with any unit trust portal or platform.

Please press “like” button below this article (if you have not done so) for email alert whenever new releases are out for public viewing. If you have any comment, please make use of the comment section below for readers’ interaction. If you want to contact the writer personally, please fill in the form below.

Lz

Sent from my Sony Xperia™ smartphone

LikeLike